Bitcoin Online Casinos in Canada

We have searched for the best Bitcoin casinos and created a ranking for you. Meanwhile, almost every online casino offers Bitcoin for deposits and withdrawals. We took a close look at the different providers to find the best Bitcoin casino 2024 for you and summarize the most important information and advantages of BTC casinos and games.

Best Bitcoin Casinos for Canadians 2024 – Our Top List

Our team has tested the top Bitcoin casinos for you. In our “list of the best”, only reliable and trustworthy offers are included.

| Wagering requirements | 40x bonus |

| 40x free spins winnings | |

| Minimum deposit | 20 USDT or equivalent |

| Maximum bet | 2 USDT |

| Bonus validity | 30 days to claim |

| 14 days to wager |

- Max bonus: 1 BTC • 150 BCH • 17 ETH • 333 LTC • 600,000 DOGE • 30,000 USDT • 42,857 XRP • 428,571 TRX • 100,000 ADA • 125 BNB • 30,000 BUSD • 30,000 USDC

- Maximum bet per round: 0.000066 BTC • 0.01 BCH • 0.0011 ETH • 0.02 LTC • 40 DOGE • 2 USDT • 2.8 XRP • 25 TRX • 6.6 ADA • 0.008 BNB • 2 BUSD • 2 USDC • 3 CAD

- Free spins are credited on “Max Miner” by Gamebeat.

| Wagering requirements | 40x bonus |

| Minimum deposit | 0,1 mBTC |

| Maximum bet | $5 per spin |

| Bonus validity | 7 days to wager |

- Max bonus amount: 1 BTC/10 ETH/10,000 USDT/10,000 USDC/100 BCH/200,000 TRX/35,000 ADA/150 LTC/125,000 DOGE

- There is no cap on winnings or withdrawals.

| Wagering requirements | 40x bonus |

| 40x free spins winnings | |

| Minimum deposit | 20 USDT |

| Maximum bet | €5 per round |

| Bonus validity | 10 days to claim |

| Bonus currency | USDT, ETH, Doge, TRX, BUSD, LTC, XRP or BNB |

- Max bonus: 1 BTC / 10,000 USDT / 10 ETH / 130,000 DOGE / 35,000 TRX / 10,000 BUSD / 120 LTC / 20,000 XRP/ 40 BNB.

- Switch your wallet to mBTC (μBTC), USDT, ETH, DOGE, TRX, BUSD, LTC, XRP or BNB to use the offer.

- The free spins are given on Sweet Bonanza.

| Wagering requirements | No wagering |

| Minimum deposit | 50 USD |

- Free spins are credited on “Book of Dead”.

- Maximum win: 100 USD.

- Winnings from the free spins are directly credited to the real balance.

| Wagering requirements | 35x bonus |

| 35x free spins winnings | |

| Minimum deposit | €20 |

| Maximum bet | €5 |

| Bonus validity | 14 days for deposit bonus |

| 7 days for free spins |

- This bonus has no limit.

- 10 Free Spins per day over ten (10) days on Gates of Olympus or Book of Ra Deluxe.

| 1st deposit | 100% up to 250 USDT |

| 2nd deposit | 100% up to 250 USDT |

| 3rd deposit | 100% up to 500 USDT + 50 FS |

| Wagering requirements | 35x bonus |

| 10x free spins winnings | |

| Minimum deposit | 20 USDT or equivalent |

| Bonus validity | 5 days |

- The free spins are available for the Gates of Olympus slot.

- While USDT is the default, other cryptocurrencies are also eligible for the bonus.

| 1st deposit | 100% up to 2,500 USDT |

| 2nd deposit | 75% up to 1,500 USDT |

| 3rd deposit | 50% up to 1,000 USDT |

| Wagering requirements | 50x deposit + bonus |

| Minimum deposit | Any amount |

| Bonus validity | 7 days to wager |

- Maximum bet (slots): 0.00024000 BTC, 0.00340000 ETH, 0.060000 LTC, 72.45 DOGE, 14.3300 ADA, 87.25 TRX, 5.00 USDT (TRC20), 5.00 USDT (ERC20), 0.0177 BNBBSC, 5.00 BUSD, 0.0177 BNB, 12.82 XRP or equivalent.

- Maximum bet (live games): 0.00048000 BTC, 0.00680000 ETH, 0.121000 LTC, 144.9 DOGE, 28.6100 ADA, 174.39 TRX, 10.00 USDT (TRC20), 10.00 USDT (ERC20), 0.0353 BNBBSC, 10.00 BUSD, 0.0353 BNB, 25.63 XRP or equivalent.

| Wagering requirements | 40x deposit + bonus |

| Minimum deposit | None |

| Maximum bet | 0.2100 mBTC |

| Bonus validity | 7 days |

- Bonus amount rewarded after wagering requirement is met.

- Max bonus: 1 BTC / 1,000 mBTC.

- Different games contribute differently to the wagering requirement.

| 1st deposit | 180% up to $20,000 |

| 2nd deposit | 240% up to $40,000 |

| 3rd deposit | 300% up to $60,000 |

| 4th deposit | 360% up to $100,000 |

| Wagering requirements | * 1% * 20% as a formula |

| $1 rakeback per $500 | |

| Minimum deposit | Varies per deposit |

- While BC Dollar (BCD) is the default, it is 1:1 with USD.

- Not a classic bonus, but rakeback.

- No maximum duration.

- Once the bonus is unlocked, it can be immediately paid out.

| Wagering requirements | 35x deposit + bonus |

| 40x free spins winnings | |

| Minimum deposit | C$30 |

| Maximum bet | C$7.50 |

| Bonus validity | 10 days to wager |

- Free spins are provided in a set of 20 per day for 10 days.

- Neteller and Skrill deposits don't qualify for the bonus.

| Wagering requirements | 40x deposit + bonus |

| Minimum deposit | None |

| Maximum bet | 0.2100 mBTC |

| Bonus validity | 7 days |

- Bonus amount rewarded after wagering requirement is met.

- Max bonus: 1 BTC / 1,000 mBTC.

- Different games contribute differently to the wagering requirement.

| Wagering requirements | 40x bonus |

| Minimum deposit | 20 USDT |

| Maximum bet | 5 USDT |

| Bonus validity | 3 days to activate |

| 5 days to wager |

- The maximum win amount is equal to the cashback bonus amount.

- Only real money loss is counted towards receiving Cashback bonus.

- You can wager cashback bonus in slot games only.

| 1st deposit | 100% up to 1 BTC + 200 free spins |

| 2nd deposit | 50% up to 2 BTC |

| 3rd deposit | 50% up to 2 BTC |

| Wagering requirements | 40x bonus |

| 40x free spins winnings | |

| Minimum deposit | Depends on payment method |

| Maximum bet | C$5 |

| Bonus validity | 7 days to wager |

- Max bonus (1st deposit): 10 ETH/200,000 TRX/10,000 USDT/10,000 USDC/100 BCH/30,000 ADA/100,000 Doge/150 LTC

- Max bonus (2nd and 3rd deposit): 20 ETH/400,000 TRX/20,000 USDT/20,000 USDC/200 BCH/70,000 ADA/250,000 DOGE/300 LTC

- Free spins: 20 free spins per day for 10 days.

| 1st deposit | 100% up to C$450 + 30 free spins |

| 2nd deposit | 50% up to C$500 + 35 free spins |

| 3rd deposit | 25% up to C$600 + 40 free spins |

| 4th deposit | 25% up to C$650 + 45 free spins |

| Wagering requirements | 35x bonus |

| 35x free spins winnings | |

| Minimum deposit | 1st deposit: C$14,5 |

| 2nd–4th deposit: C$21,5 | |

| Maximum bet | C$7 |

| Bonus validity | 7 days to wager |

- Crypto is excluded from the bonus.

- E-mail and phone number must be verified.

- Slots count 100%, MegaGames count 200%.

| 1st deposit | 150% up to 3BTC + 100 free spins |

| 2nd deposit | 120% up to 3BTC + 50 free spins |

| 3rd deposit | 110% up to 3BTC + 50 free spins |

| 4th deposit | 100% up to 3BTC + 50 free spins |

| Wagering requirements | Wager bonus 40x |

| Wager free spins winnings 40x | |

| Minimum deposit | 30 USDT or equivalent |

| Bonus validity | 7 days |

- Minimum deposit: 0.001 BTC, 0.2 BCH, 0.018 ETH, 500 DOG, 0.3 LTC, 30 USDT, 70 XRP, 0.135 BNB, 120 ADA, 450 TRX.

- Maximum stake per spin: C$7.

- Max bonus and free spins cashout apply.

- Free spins will be awarded on Book of the Fallen (Pragmatic).

| 1st deposit: | 100% up to 1 BTC + 100 Free Spins |

| 2nd deposit: | 50% up to 1,25 BTC + 50 Free Spins |

| 3rd deposit: | 50% up to 1,25 BTC |

| 4th deposit: | 100% up to 1,5 BTC + 50 Free Spins |

| Wagering requirements: | 40x the bonus amount |

| 40x the winnings from Free Spins | |

| Minimum deposit: | 0.001 BTC |

- The bonus is so high ONLY with crypto, otherwise 4×2,000 CAD

- The rest of the bonus codes are: LVL2, LVL3, LVL4

- The minimum deposit for bonuses 2,3 and 4: 0.0005 BTC

- Max. winnings for Free Spins: 50 EUR, 50 USD, 0.0025 BTC, 0.43 BCH, 0.04 ETH, 1 LTC, 850 DOG, 50 USDT

| Wager bonus and winnings from free spins 60x |

- 100% on the first deposit up to 100,000 USDT + 30 free spins

- 75% on the second deposit up to 75,000 USDT + 30 free spins

- 75% on the third deposit up to 75,000 USDT + 30 free spins

- 200% on the fourth deposit up to 200,000 USDT + 50 free spins

- Wager bonus and winnings from free spins 60x

| 1st deposit | Up to 100% + 30 free spins |

| 2nd deposit | Up to 75% + 30 free spins |

| 3rd deposit | Up to 75% + 30 free spins |

| 4th deposit | Up to 200% + 50 free spins |

| Minimum deposit: | 20 USDT |

-

To receive 50% bonus + 10 free spins, a deposit of min. 20 USDT must be made. Maximum bonus amount: 125 USDT

-

To receive 75% bonus + 20 free spins, a deposit of min. 250 USDT must be made. Maximum bonus amount: 375 USDT

-

To receive 100% bonus + 30 free spins, a deposit of min. 500 USDT must be made. Maximum bonus amount: 100,000 USDT

| 1st deposit: | 100% up to C$500 + 50 free spins |

| 2nd deposit: | 50% up to C$750 |

| 3rd deposit: | 50% up to C$750 + 50 free spins |

| Wagering requirements: | 45x the bonus amount |

| 45x the winnings from free spins | |

| Minimum deposit: | C$30 |

| Bonus validity: | 7 days |

- If you deposit C$70 or more on your FIRST and THIRD deposits, you can activate 50 free spins via support and get a total of 100 free spins.

- Contact live chat to get 50 additional free spins when depositing more than C$70.

- Players must claim the free spins within 24 hours of making the deposit.

| 1st deposit: | 100% bonus up to 1.5 BTC + 100 free spins |

| 2nd deposit: | 50% bonus up to 1.25 BTC |

| 3rd deposit: | 50% bonus up to 1.25 BTC |

| 4th deposit: | 100% bonus up to 1 BTC |

| Wagering requirements: | 40x the bonus and the deposit amount |

| 45x the winnings from free spins | |

| Bonus validity: | 14 days |

- Slots count 100% toward the wagering requirement

- Live games don’t count

- Maximum bonus cashout: unlimited

- Maximum C$100 cashout (winnings from free spins)

- Use bonus code for 2nd-4th deposit

| Minimum deposit: | C$30 |

| 1st deposit: | 100% Bonus up to C$750 + 200 Free Spins |

| Maximum bonus amount: | C$750 |

- Bonus must be wagered 35x

- Free spins must be wagered 40x

| Wagering requirements: | 40x bonus |

| Wagering requirements: | 40x winnings from free spins |

| Minimum deposit: | €20 |

- 1st deposit: 100% up to €250 (Street Kid)

- 2nd deposit: 25% up to €500 (Cyber Wolf)

- 3rd deposit: 75 Free Spins (Master Of Coins)

- Bonus must be wagered 40x

- Winnings from free spins must be wagered 40x

- Minimum deposit €20

- Validity period: 10 days

| Minimum deposit: | 0.001 BTC |

| Maximum bonus amount: | $10,000 |

- Bonus must be wagered 45x.

| 1. deposit: | 100% up to €200 |

| 2. deposit: | 50% up to €300 |

| 3. deposit: | 50% up to €400 |

| 4. deposit: | 100% up to €100 |

| Wagering requirements: | NONE! |

| Minimum deposit: | €20 |

- Bonus has no wagering requirements. You get the bonus and have to wager it once. You can directly keep the winnings from this turnover.

- Maximum winnings are five times the bonus.

- Maximum bet per round is €4.

| Without deposit: | 20 TXT |

| 1. deposit: | 100% up to 1 BTC + 25 FS |

| 2. deposit: | 75% up to 1 BTC |

| 3. deposit: | 50% up to 1 BTC |

| Wagering requirements: | 35x the bonus amount |

| 35x the winnings from free spins | |

| Bonus validity period: | 7 days |

| Minimum deposit: | 10 USDT |

- Maximum bet while wagering: 0.00007 BTC / 0.001 ETH / 2 USDT / 2 USDC / 0.022 LTC / 2.7 EOS / 2 EUR

- Maximum bonus: 1 BTC / 50 ETH / 30.000 USDT / 30.000 USDC / 335 LTC / 40700 EOS / 30,000 EUR

- Dice and Crash don't qualify for the bonus

- Minimum deposit for the 2nd deposit bonus: 15 USDT / 15 EUR / 0.0004 BTC / 0.006 ETH / 15 USDC / 0.17 LTC / 20 EOS

- Minimum deposit for the 3rd deposit bonus: 20 USDT / 20 EUR / 0.0005 BTC / 0.008 ETH / 20 USDC/ 0.22 LTC/ 27 EOS

| Minimum deposit: | C$30 |

- Bonus must be wagered 50x

- The offer is not valid when depositing with Skrill

- Slots contribute 100%

- Live casino games contribute 10%

- Many games are excluded, see bonus conditions

| 1st deposit | 100% up to C$300 + 70 free spins |

| 2nd deposit | 50% up to C$750 + 70 free spins |

| 3rd deposit | 50% bonus up to C$750 + 50 free spins |

| 4th deposit | 40% up to C$800 + 40 free spins |

| 5th deposit | 60% up to C$400 + 70 free spins |

| Wagering requirements | 45x the bonus amount |

| 45x the winnings from free spins | |

| Bonus validity period | 7 days |

| Minimum deposit | C$30 |

- In order to get free spins with every deposit, the deposit MUST be at least C$70.

- To activate the bonus, you must contact the casino via live chat or send an email to [email protected].

| 1st deposit | 100% up to C$1,500 + 150 free spins |

| 2nd deposit | 75% up to C$1,500 |

| 3rd deposit | 50% up to C$1,500 + 50 free spins |

| 4th deposit | 100% up to C$1,500 |

| Wagering requirements | 45x the bonus amount |

| 45x the winnings from free spins | |

| Minimum deposit | C$30 |

| Validity | 5 days |

- Maximum bet during bonus wagering: C$5 per spin.

- Slots count 100% towards bonus wagering (exceptions in bonus terms and conditions).

| Wagering requirements: | 50x the bonus amount |

| 50x the winnings from free spins | |

| Minimum deposit: | C$25 |

- No bonus for crypto deposits

- Maximum bet while bonus wagering C$6.5

- Slots count 100%

- Roulette, poker count 5%

- Table games count 5%

| 1st deposit: | 100% bonus up to 1 BTC +180 free spins |

| 2nd deposit: | 50% bonus up to 1 BTC |

| 3rd deposit: | 50% bonus up to 2 BTC |

| 4th deposit: | 100% bonus up to 1 BTC |

| Wagering requirements: | 40x the bonus amount |

| 40x the winnings from free spins | |

| Minimum deposit: | C$20 per deposit |

| Validity: | 7 days |

- Slots count 100%

- Other games count 5%

| Wagering requirements | 45x the bonus amount |

| 50x the winnings from free spins | |

| Minimum deposit | 0.001 BTC / C$20 |

| 1st deposit | 100% up to 1.5 BTC / C$400 + 100 free spins |

| 2nd deposit | 75% up to 1.25 BTC / C$500 – Code: 2DEP |

| 3rd deposit | 50% up to 1.25 BTC / C$1000 – Code: 3DEP |

| 4th deposit | 100% up to 1 BTC / C$4100 – Code: 4DEP |

- Free spins on Book of Dead, Wolf Treasure, Caishen's Gifts

- Video slots count 100%

- All other games count 5%

- Live games don't count

| Wagering requirements: | 30x the bonus amount |

| 30x the winnings from free spins | |

| Minimum deposit: | 0.001 BTC |

| 1st deposit: | 110% bonus up to 1.5 BTC + 250 free spins |

| 2nd deposit: | 100% bonus up to 1.5 BTC + 100 free spins |

| 3rd deposit: | 100% bonus up to 1.5 BTC |

| 4th deposit: | 100% bonus up to 1.5 BTC |

- Slots count 100%

- Maximum bet: 0.00015 BTC

| Minimum deposit: | |

| Wagering requirements: | $100 |

- The bonus code KC500 must be used.

- This is an exclusive offer only through us.

- Bonus and deposit must be wagered 30x.

- Minimum deposit for the bonus is $100.

| Minimum deposit: | 0.0006 BTC |

| Bonus code: | |

- Bonus must be wagered 40x

- The offer is only valid for new customers via Kryptocasinos.com

- The minimum deposit is 0.0006 BTC

- Use bonus code CANDY130

- Free spins apply to the “Candy Monsta”

- Maximum bonus: 1 BTC, 75 BCH, 15 ETH, 250 LTC, 250,000 DOG and 50,000 USDT

| Minimum deposit: | $20 |

| Maximum bonus amount: | $700 |

| Bonus validity period: | 30 days |

- The package is divided into 7 batches. As you play, you'll gain XP and unlock the bonus cash.

| Minimum deposit: | C$15 per deposit |

| 1st deposit: | 125% up to C$150 |

| 2nd deposit: | 100% up to C$300 + 25 free spins |

| 3rd deposit: | 80% up to C$750 + 50 free spins |

- The 2nd and 3rd deposits come with free spins on Deep Sea or Four Lucky Clover (BGaming).

- Skrill and Neteller payments don't qualify for the welcome bonus.

- The bonus must be wagered 45x.

- The bonus is valid for 14 days.

| Wagering requirements: | 50x the bonus amount |

| Minimum deposit: | 2 CAD |

- Wager bonus 50x

- Cryptocurrency deposits don’t qualify for the bonus

| Minimum deposit: | C$30 |

| Maximum bonus amount: | C$3,750 + 150 Free Spins |

| Wagering requirements: | 45x |

| 1st deposit: | 100% up to C$1,500 + 50 Free Spins (Wild Сash and Big Atlantis Frenzy) |

| 2. Deposit: | 50% up to C$750 + 50 Free Spins |

| 3. Deposit: | 75% up to C$1,500 + 50 Free Spins |

| Bonus validity period: | 7 days |

- Bonus must be wagered 45x

- Unclaimed bonus Free Spins expire in 7 days after being credited to the player’s account

- Maximum winning from Free Spins: C$300

- Maximum bet during bonus wagering: C$5

- Highroller 1st deposit: 125% bonus up to C$2,500 + 75 Free Spins

- Highroller 2nd deposit: 75% bonus up to C$1,500 + 75 Free Spins

- Highroller 3rd deposit: 100% bonus up to C$3,500 + 75 Free Spins

| 1st deposit: | 100% up to 0.2 BTC |

| 2nd deposit: | 100% up to 0.2 BTC |

| 3rd deposit: | 100% up to 0.2 BTC |

| Wagering requirements: | 40x the bonus amount |

| 40x the winnings from free spins | |

| Minimum deposit: | C$20 (C$90 for 100 free spins) |

- You get 20 free spins for a C$20 deposit.

- You get 50 free spins for a C$40 deposit.

- You get 100 free spins for a C$90 deposit.

- Maximum bet per spin while wagering is C$10 (or equivalent in crypto).

| 1st deposit | Up to 170% (including the 20% boost) + up to 50 Free Spins |

| 2nd deposit | Up to 200% (including the 20% boost) + up to 75 Free Spins |

| 3rd deposit | Up to 220% (including the 20% boost) + up to 100 Free Spins |

| Wagering requirements | 40x bonus |

| 40x free spins winnings | |

| Minimum deposit | Varies per deposit and per tier |

| Example (1st deposit): | |

| Low tier | $30-$199 = 110% (including the 10% boost) + 25 Free Spins |

| Medium tier | $200-$499 = 130% (including the 10% boost) + 25 Free Spins |

| High tier | $500+ = 170% (including the 20% boost) + 50 Free Spins |

| Maximum bet | Varies per deposit and per tier |

| Bonus validity | 7 days to claim |

| 14 days to wager |

- Each deposit bonus can be boosted (with a higher percentage if used during the first 10 min).

- Max bet per spin and max win per spin: vary per deposit and per tier

- Games contributions. Slots: 100%, Original games: 20%, Other games: 0%

| Wagering requirements: | None |

| Minimum deposit: | 5 mBTC |

| Wagering requirements: | 40x the bonus amount |

| 40x the winnings from Free Spins | |

| Minimum deposit: | 0.002 BTC |

- Minimum deposit in other currencies: 70 USDT, 0.064ETH, 0.5 LTC, 8,000 DOG, 940 XRP and 0.144 BCH

- Time to wager the deposit bonus: 32 days

- Time to wager the winnings from Free Spins: 14 days

| Wagering requirements: | 40x the bonus amount |

| 40x the winnings from free spins | |

| Minimum deposit: | C$30 |

| 1st deposit: | 100% bonus up to C$180 + 120 free spins |

| 2nd deposit: | 50% bonus up to C$150 + 50 free spins |

| Free spins for: | Elvis Frog in Vegas + Great Rhino Megaways |

| Max. bet limit: | C$8 per round |

- Cryptocurrency deposits don’t qualify for the bonus

| Wagering requirement: | 100 loyalty points: 10 USDT |

| Minimum deposit: | 0.001 BTC |

| Validity: | 60 days |

| Maximum bonus amount: | 5 BTC or equivalent |

- Welcome Bonus Points = Converted Stake x 0.008 x (100-RTP)

- For every 150 welcome bonus points you earn, one increment of the bonus (0.001 BTC) gets released.

| Wagering requirements: | Bonus and deposit must be wagered 30 times. |

| Winnings from free spins must be wagered 25 times. | |

| Minimum deposit | $20 |

| 1st deposit | 100% bonus up to $500 + 100 free spins |

| 2nd deposit | 100% bonus up to $500 |

| 3rd deposit | 100% bonus up to $500 |

| Free spins on | Big Bass Bonanza |

- Bonus and deposit must be wagered 30x

- Winnings from free spins must be wagered 25x

- Slots contribute 100%

- Live games 10%

- Table games 5%

- Jackpots 0%

- Skrill, Neteller, ecoPayz, Paysafecard deposits don’t qualify for the bonus

| Wagering requirements: | Wager bonus 5x |

| VIP level: | Starting from the VIP level Newbie 2 |

| Period: | Every Monday (12:00 UTC – 13:00 UTC) |

| Max. cashback: | 5,000 USDT |

| Validity period: | 7 days |

- The wagering requirement for the cashback is x5

- Cashback is available if your minimal loss value for the last 3 days is greater than 1 USDT

- The maximum size of cashback is 5,000 USDT

- The cashback is valid for 7 days

Our Top 3 BTC Online Casinos in Detail

Discover the reasons behind the top 3 online casinos that accept Bitcoin in this section. We'll explain why we ranked them the way we did.

1. Bets.io

Bets.io surprisingly ended up on top, but in the end, they have the best combination of game selection, cryptocurrencies, bonuses and trustworthiness (Dama BV has been an established license holder for a long time).

Game Offer at Bets.io

The game selection is excellent. We found the games we were looking for in all the areas and never felt anything was missing. There are casinos that offer a few more options but at the cost of big weaknesses that we don't want to accept.

Bonus at Bets.io

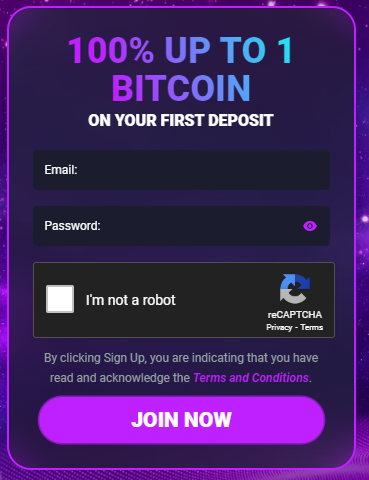

The bonus at Bets.io is 100% up to 1 BTC. The bonus must be wagered 40x. The offer is valid for 14 days. The same conditions apply to winnings from free spins.

- Huge selection of slots

- Renowned game developers

- 2-factor authentication

| Wagering requirements | 40x bonus |

| 40x free spins winnings | |

| Minimum deposit | 20 USDT or equivalent |

| Maximum bet | 2 USDT |

| Bonus validity | 30 days to claim |

| 14 days to wager |

- Max bonus: 1 BTC • 150 BCH • 17 ETH • 333 LTC • 600,000 DOGE • 30,000 USDT • 42,857 XRP • 428,571 TRX • 100,000 ADA • 125 BNB • 30,000 BUSD • 30,000 USDC

- Maximum bet per round: 0.000066 BTC • 0.01 BCH • 0.0011 ETH • 0.02 LTC • 40 DOGE • 2 USDT • 2.8 XRP • 25 TRX • 6.6 ADA • 0.008 BNB • 2 BUSD • 2 USDC • 3 CAD

- Free spins are credited on “Max Miner” by Gamebeat.

2. Metaspins.com

During our test run, we were surprised to find Metaspins casino in second place among the best Bitcoin casinos. Despite being a fairly new casino, they've managed to excel in many areas. Everything is just as it should be, from the generous bonus to the excellent selection of games.

Game Offer at Metaspins.com

In total, there are about 50 game providers, including all the important and smaller options that we would like to see in order to call an offer complete. In addition, there is a very good live casino with no shortcomings whatsoever.

Bonus at Metaspins.com

The bonus here is 100% up to 1 BTC. The bonus and deposit must be wagered 25x, and the minimum deposit is quite low at 0.1 mBTC. The fact that you only have seven days to wager prevented it from reaching first place in the end.

- Great selection of games

- Very good bonus

- Very impressive website

| Wagering requirements | 40x bonus |

| Minimum deposit | 0,1 mBTC |

| Maximum bet | $5 per spin |

| Bonus validity | 7 days to wager |

- Max bonus amount: 1 BTC/10 ETH/10,000 USDT/10,000 USDC/100 BCH/200,000 TRX/35,000 ADA/150 LTC/125,000 DOGE

- There is no cap on winnings or withdrawals.

3. Empire.io

Empire.io had almost everything to become the best Bitcoin casino, and in the end, it just barely slipped past the first place. The casino is managed by the same operators as the popular and well-known Bitcasino.io and is really successful in all respects.

Game Offer at Empire.io

What we didn't like so much was that several big providers were missing. However, the game selection was very good, and we even discovered some unusual software solutions. Their connection with the Hub88 aggregator could be the reason behind this. The selection of cryptocurrencies besides Bitcoin has been limited to essentials, but the payouts are the fastest on the market.

Bonus at Empire.io

A bonus here is also 100% up to 1 BTC. The bonus and deposit must be wagered 25x. The maximum bet per round is C$5 during the wagering.

- Numerous unknown game providers

- Operated by a well-known casino group

- Very professional support

| Wagering requirements | 40x bonus |

| 40x free spins winnings | |

| Minimum deposit | 20 USDT |

| Maximum bet | €5 per round |

| Bonus validity | 10 days to claim |

| Bonus currency | USDT, ETH, Doge, TRX, BUSD, LTC, XRP or BNB |

- Max bonus: 1 BTC / 10,000 USDT / 10 ETH / 130,000 DOGE / 35,000 TRX / 10,000 BUSD / 120 LTC / 20,000 XRP/ 40 BNB.

- Switch your wallet to mBTC (μBTC), USDT, ETH, DOGE, TRX, BUSD, LTC, XRP or BNB to use the offer.

- The free spins are given on Sweet Bonanza.

Best Bitcoin Casinos by Category

Who is our test winner is obvious very quickly, but who can convince in detail, who wins in certain disciplines?

| Category | BTC Casino |

| ? Best BTC Bonus | Bets.io |

| ?️ Best Game Selection | Playzilla |

| ? Newest BTC Casino | Jackbit |

| ? Best Payment Methods | BC.Game |

| ? Best Live Casino | Empire.io |

| ? Best Mobile Casino | Metaspins |

| ? Overall Test Winner | Bets.io |

| ? Best Support | Empire.io |

| ? Fastest Payouts | BC.Game |

Advantages of Bitcoins in Casinos

The use of Bitcoins has advantages and disadvantages. The advantage of this cryptocurrency is the independence of the economic development of other currencies.

Using Bitcoins is also very simple. You only need software on a PC or cell phone to process a payment. The fees charged for payment are low, which is another advantage.

A high degree of anonymity makes Bitcoin a popular form of payment at BTC casinos. Even though you are not one hundred percent anonymous when paying with cryptocurrency, not every transaction is monitored in the way that, for example, FIAT currencies are.

With increasing inflation, Bitcoin also seems to be a very popular method to protect your money. On top of that, we are discovering better welcome bonus offers.

Disclaimer: We are big BTC fans, but you must take it with a grain of salt when the currency is traded as a 100% hedge against inflation. There are still too many fortune-hunters around for that.

Expert Opinion on Bitcoin Use in Casinos

Especially if you want to keep track of how much money you invest in online casinos, it can be advantageous to track the related expenses and, at best, income via your e-wallet. This way, these amounts remain clearly separated from your bank account.

Another advantage of using Bitcoin over real money is that you are not subject to fluctuations in exchange rates when you play at casinos located abroad.

Disadvantages of Bitcoins in Casinos

Besides advantages, there are also some disadvantages we need to draw attention to. One of them is acceptance. Some casinos still don’t accept Bitcoins as a means of payment. Therefore, Bitcoins can probably not yet be called a standard payment method.

Another disadvantage is the fluctuating price. Bitcoins can gain value but also lose it within a short time. This also happens with other currencies but usually not to such an extreme degree.

The issue of security could also be a drawback. Since Bitcoins are stored in a digital wallet, the coins could be stolen in case of virus attack on an online casino. However, many casinos are getting much better equipped in this regard and strive to offer players the highest possible security.

If you have a large sum of Bitcoins, you should store them in a cold wallet for protection.

An advantage can be a disadvantage at the same time. The fact that we also see a welcome bonus of up to 5 BTC is convincing, but with such a bonus offer, you tend to forget how much money you really deposited. This would be a welcome bonus of over 200,000 dollars/euros in a classic real money casino.

Finding the Right Bitcoin Casino

Those Canadian players who have never used Bitcoin at an online casino probably have questions about it. Everything works the same as with any other payment method. Nevertheless, you have to pay attention to a few things. We want to share our experience on the following topics with you:

Bonus – Are there any no deposit bonus offers for Bitcoin casinos?

Deposit and Withdrawal – What are the special features of Bitcoin?

Security – What should I look out for at Bitcoin casinos?

Live Casino With Bitcoin – Which games are available?

Mobile Apps – Does the casino offer apps or web apps?

Game Offer – How large is the game selection?

Customer Service – What makes a good online casino?

Bonus in Bitcoin Casinos

An exclusive welcome bonus or new customer bonus can hardly ever be found at a Bitcoin casino. If at all, BTC casino awards free spins as a welcome package instead of a real money starting balance. As usual, these bonuses are subject to wagering requirements. They are great for new players who want to test the respective Bitcoin casino first or increase their chances of winning by playing more games with the bonus.

You can find the maximum bonus offers and all other information about bonus money, promotions and codes in the casino’s bonus terms.

What is striking is how different the deposit bonus is. While some offer a normal sum and only a few mBTC, some casinos bang out up to 5 BTC, which can then be credited.

Note: The very high bonus offers at some Bitcoin casinos are not structured in the same way as classic bonuses in online casinos. They are much more like cashback offers or rakebacks, known to us from poker offers.

Deposit and Withdrawal of Bitcoin in Online Casinos

Not only is the deposit of Bitcoins in online casinos super easy, but the withdrawal is also straightforward. We take a closer look at this topic.

Deposit

You must own Bitcoins in order to choose them as a deposit method or first exchange real money for Bitcoin in exchange. A wallet required for this purpose – to deposit bitcoins – is quick and easy to set up.

At Bitcoin online casino, you can select to pay using virtual currency and you will be given an address to which you should send your Bitcoins. How you send the BTC to the generated address depends on where you stored them. So you can do that through your app or the exchange's website. Once the steps are done, the funds will be available at the online casino.

Withdrawal

The first withdrawal in any casino must first go through what is called the KYC procedure. KYC stands for “know your customer“. This process is required for all online payments to prevent money laundering. Only after your identity has been proven can a withdrawal be made. Every trustworthy online casino will therefore request a copy of your ID before making a withdrawal.

To make a withdrawal of your winnings, you must provide the online casino with the public key of your wallet. After that, the transfer is forwarded to the blockchain using the P2P (peer-to-peer) network, where it waits for confirmation. This process can take time, depending on the amount of transaction fees. If lower transaction fees are attached to your transaction, it is not as interesting to miners as it is in the case of higher fees.

How Fast Can I Start Playing with Bitcoins?

Do you already own Bitcoins? Then you can get started as soon as you create a player account at an online casino and deposit cryptocurrency. Only in extreme cases a slightly longer transaction waiting time may occur.

Security

In any transaction, security plays a major role. This is also true when it comes to payments with cryptocurrencies like Bitcoins. Below, you will find important points of this area.

How to Find Trustworthy Bitcoin Online Casinos

A reputable Bitcoin casino has a valid gambling license from a recognized state gambling authority, good customer support and an excellent game selection of casino games such as slots, roulette or blackjack.

Are Bitcoin Online Casinos Legal?

Yes, Bitcoin casinos have a valid gambling license from a reputable regulatory authority, such as the Malta Gaming Authority, which makes gambling legal. As long as online casino operators also respect the requirements, you can be sure there is no fraud.

Bitcoin casinos were a rather vague concept in the world of iGaming not so long ago. However, the software has quickly evolved and is slowly but surely catching up with traditional payment methods.

Are My Bitcoins Safe in Online Casinos?

As mentioned above, security definitely depends on licenses. Licensed casinos in Canada are safe and reputable.

Casino wallets are also protected internally by multiple safeguards in order to keep your Bitcoin funds safe.

A significant advantage when it comes to security is also a 2-factor authentication. If a casino offers 2FA, you can be sure that your user account, including coins, is even better protected.

Live Casino With Bitcoin

For Canadian players, live casino games are among the absolute highlights. Thanks to modern technology, fast and sharp streams have long been available in most Bitcoin online casinos. So you can expect a unique atmosphere while playing poker, blackjack, roulette or other table games. A very dominant provider Evolution Gaming is also represented in live casinos and this integration alone promises an excellent gaming experience. Perfect live casinos offer live games from several providers at once.

Mobile Casino & Casino App

Mobile Internet use is unstoppable in the current age and plays an important role in online casinos. The number of users who prefer to play at an online casino via a smartphone is increasing rapidly. In our selection, we pay special attention to easy mobile use for newcomers and a fast mobile website.

Game Offer – Game Selection in Bitcoin Casinos

In terms of an offer, you don’t have to make any compromises at a Bitcoin online casino. You can expect a full selection of various casino games.

If you use online casinos on the go, you know that there are different software manufacturers or developers of casino games. We have also kept an eye on the game selection for you. Our listed Bitcoin casinos have a contract with the best game developers and offer a wide range of games.

The major game developers/game providers such as NetEnt – the giant among the casino game offers – but also other manufacturers, such as Microgaming, Evolution Gaming or Pragmatic Play, provide a great deal of sophisticated entertainment in the form of table games, slots and card games.

Starburst

The slot classic from NetEnt with various gems and an outer space theme hits like a comet and thus becomes a leader among slots. You can play this slot for free or with real money/cryptocurrencies. The game's crisp graphics and the bright colours of the symbols make the experience exciting.

Book of Dead

The Book of Dead is also highly popular in Bitcoin online casinos. If you're into Temple Run, Indiana Jones or Lara Croft, this slot machine is for you. Here, too, you can play for free or by making a deposit. Play'n GO relies on a mysterious soundtrack, high jackpots and easy operation.

Customer Service

Before you sign up at an online casino, you should carefully check the provider's trustworthiness. Is there a license from a gambling authority and is it possible to contact customer service? Is live chat also available?

By answering these questions, you can tell whether you are dealing with fast and well-functioning service. Professional customer service doesn’t keep its customers waiting for a long time and is always friendly when dealing with players.

What Is Bitcoin?

Bitcoin is a cryptocurrency, which means there are certain peculiarities compared to the traditional currency we use daily. We want to explain this a little more in detail here. Let’s start with the basics: What is Bitcoin?

Bitcoin is a completely digital and decentralized means of payment. In other words, it has no physical form, i.e. banknotes or coins. Moreover, there is also no institution, no bank or stock exchange that could influence the currency. Bitcoin is also not tied to any particular country or region.

So with cryptocurrency, you can shop all over the world without needing a middleman between parties when making money transfers. This simplified process also means that Bitcoin transfer fees are minimal.

In the blockchain – a shared public ledger system – on which the entire Bitcoin network is based, all confirmed transactions are stored in individual blocks (as the name suggests).

The Bitcoin blockchain technology and the first Bitcoin code went live in January 2009 and the first Bitcoin exchange opened a year later. At that point, one Bitcoin was worth around six cents. A year later, it was valued at one dollar.

Slowly but surely, word of Bitcoin spread and the cryptocurrency grew in popularity. In 2017 the boom came. The Bitcoin price caused a sensation, rising from $3,000 in three months to a value of nearly $19,000.

Who Is Behind Bitcoin?

In 2008, a still unknown author published a white paper called Bitcoin: A Peer-to-Peer Electronic Cash System under the pseudonym Satoshi Nakamoto. This letter was the birth of the cryptocurrency Bitcoin.

His idea was to develop a secure decentralized payment system that could be handled directly from user to user (peer-to-peer) without government agency or bank control. A year later, in 2009, the first Bitcoin code went live.

How Secure Is Bitcoin?

We have already touched on the security of Bitcoin payments several times in this article, but without going into any detail. Here are some important facts:

Anonymity of Payment

On the Internet, you can read over and over again that Bitcoin is an anonymous currency. This is wrong. When paying with Bitcoin, you have an insight into the public key of the sender and recipient and can, therefore, track the payment flow. Thus, there is no complete anonymity when paying with Bitcoins.

Nevertheless, Bitcoins are the best pseudo-anonymous currency. However, for law enforcement, transactions can very well be tracked.

Responsibility for the Keys

As mentioned further above, Bitcoins are a decentralized currency. This means you can't keep your money at a bank (as you can with real money) and are therefore responsible for it yourself. So if you have stored your Bitcoins in a wallet on your PC, the security is your responsibility.

If your PC is hacked, for example, Bitcoins can be stolen. If you forget your password – that is, the Private Key – you may never be able to access your coins again. This key also cannot be changed and is unrecoverable if lost. Therefore, you must keep your Private Key safe and store it immediately after creating it.

Bitcoin Casino Alternatives

Do people actually need an alternative to Bitcoins? Bitcoin supporters would undoubtedly answer this question with no because Bitcoin is the largest and most well-known cryptocurrency. However, here’s a list of other cryptocurrencies that can be used at an online casino:

Conclusion About Bitcoin Online Casinos

Our Bitcoin online casino experience is consistently positive. There are now numerous BTC casino providers (our complete list of all Bitcoin casinos) and their number is increasing every day. Once you’ve got to grips with Bitcoin and the blockchain, payments are also smooth. In our opinion, Canadian players can benefit most from the low transaction fees.

We are convinced the Bitcoin casino market will continue to grow in Canada and around the world. We are just at the beginning of the spread of this payment method. You can find all new Bitcoin online casinos openings in our list of new Bitcoin online casinos.

Bitcoin Casinos – FAQ

On bitcoin.org, you can find the wallet that suits you best. You can filter by the operating system as well as by hardware. Overall, security is the name of the game here – whether you have a few mBTC or a lot of assets.

At Bitcoin casino, you will also find typical bonuses such as a welcome bonus, which most often takes the form of free spins. The number of great welcome packages, which are a mixture of free spins and a deposit bonus, is also increasing. However, the so-called no deposit bonus, i.e. a bonus without a deposit, is rarely or never found.

Apart from the miner fees, there are usually no other costs or fees on the part of the casino.

If you have found an online casino that offers a live casino, you can also wager your Bitcoins there.

In most online casinos, several deposit and withdrawal methods are available. So you are free to choose whether you want to deposit with Bitcoin, another cryptocurrency, e-wallets or FIAT currency.

Unfortunately, you have to risk any disadvantages resulting from exchange rate fluctuations. You decide with which currency you place your bet and how much it will be. The casinos do not take any risk with regard to exchange rate fluctuations.

More pages

Advertising transparency

Advertising transparency